Employers - What you need for Inspections |

Functions

The Workplace Relations Commission’s Inspection Services promote, encourage and enforce compliance with a range of employment legislation. This is carried out by means of compliance inspections at workplaces, by working with employers to address contraventions and, where necessary, issuing notices to employers and bringing legal proceedings to enforce compliance.

Legislation enforced by Inspection Services

Legislation | Relevant Provisions enforced by Inspectors |

Organisation of Working Time Act, 1997 | Rest breaks, Rest periods, notification of start and finish times, annual leave, public holiday and Sunday work entitlements, working time records, |

National Minimum Wage Act 2000 | Entitlement to statutory minimum hourly rate of pay, records to demonstrate compliance with Act, Statement of average hourly rate of pay, |

Employment Permits Acts 2003, 2006 & 2024 | Permissions for non-EEA nationals to work in the State, records of employment permits and permit holders, |

Payment of Wages Act, 1991 | Methods/modes of payment, Statements of wages and deductions, Underpayments, Unauthorised deductions, Tips and Gratuities Notices, Statements of Tips and Gratuities distributed, Treatment of Service Charges |

Terms of Employment (Information) Act, 1994 | Statement of terms of employment, Statement of core terms of employment (‘Day 5’ Statement), Statement of terms of employment (outside State), Notification of changes to terms of employment |

Protection of Young Persons (Employment) Act, 1996 | Employment of children and young persons, rest breaks and rest periods, proof of age, parental/guardian consent, Protection of Young Persons Register, Records to show compliance with 1996 Act, Display of abstract of 1996 Act, |

Industrial Relations Act, 1946 | Records to show compliance with Employment Regulation Orders (EROs), |

Industrial Relations (Amendment) Act, 2015 | Records to show compliance with Sectoral Employment Orders (EROs), |

Employment Agency Act, 1971 | Requirement to hold employment agency licence, |

Carer’s Leave Act, 2001 | Leave during first 13 weeks of carer’s leave, |

Maternity Protection Act, 1994 | Health and safety leave, Certificates of health and safety leave, Prescribed payments for first 21 days of health and safety leave, |

Paternity Leave and Benefit Act, 2016 | Records of paternity leave, |

Sick Leave Act, 2022 | Records of statutory sick leave, |

Protection of Employees (Temporary Agency Work) Act, 2012 | Treatment of agency workers |

Reasons for Inspections

The primary objective of inspections and associated enquiries is to achieve compliance with employment legislation.

An Inspector may on occasion be accompanied by other Inspectors from the WRC, the Department Social Protection, the Revenue Commissioners or by members of An Garda Síochána.

Inspections may arise from a number of sources:-

Sources/Reasons for Inspections

- Complaints by employees, employers, citizens and others

- Referrals from other enforcement agencies (Revenue, Social Protection, Garda, etc)

- Targeted sectoral campaigns (e.g. seasonal workers, construction, commercial sea fishing, etc.)

- EU initiatives (e.g European Labour Authority, EU Undeclared Work Platform))

- Employment Permit verification checks and referrals (Department of Enterprise, Tourism & Employment)

- Risk assessments

- Routine checks

Inspectors’ Powers

Inspectors are appointed by the Director General, with the consent of the Minister for Enterprise, Tourism & Employment, under the Workplace Relations Act 2015.

WRC Inspectors are also appointed by the Minister as Authorised Officers for the purposes of the Employment Permits Acts 2003 to 2014.

Inspectors visit places of employment and carry out investigations and enquiries to

- determine compliance with employment-related legislation (working time, payment of wages, minimum wage, terms of employment, etc.), and

- check that foreign nationals working in the State have a valid permission to work.

WRC Inspectors may, in general:

- enter at all reasonable times any place or work,

- require the production of such books, records or documents as may reasonably be required,

- inspect and take copies, of any books, documents or records,

- remove any such books, documents or records and retain them for such period as is necessary,

- require any person to give such information or assistance as is required,

- interview employers and employees, and

- issue Directions, Compliance Notices and Fixed Payment Notices in certain circumstances.

Types of Inspection

Type | No of Compliance Checks | Announced/ Notice given | Unannounced/ No Notice given |

Full | 130 | Yes |

|

Employment Permit and Protection of Young Persons | 20 |

| Yes |

Fisheries | 50 | Yes | Yes |

Employment Permit verification checks | 17 | Yes | Yes |

Inspection Process

Information in relation to the inspection process is available in the Guide to WRC inspections & Employers - What you need for inspections.

Full inspections, involving some 130 compliance checks, will in general be carried out by prior appointment. 14 days’ written notice is given to employers of such inspections. The appointment letter requests employers to make the following records available in respect of all persons employed in their businesses in the past 12 months

Records to be available at Inspections |

|

Unannounced inspections are also undertaken, many outside normal business hours, in particular to monitor compliance with the Protection of Young Persons (Employment) Act, 1996 and Employment Permits Acts 2003, 2006 & 2024 and to identify non-compliance risks across employment legislation generally. Such inspections may involve up to 50 compliance checks.

As part of the inspection, Inspectors will interview the employer or employer representative and a sample of employees, review employment records and make such enquiries as are necessary to determine compliance. Copies of records may be taken or, where this is not possible, the original records may be removed and returned to the employer following examination.

Follow up to Inspections (Contravention Notice)

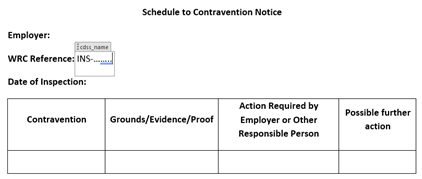

Where contraventions are detected at the inspection, the employer will be advised and a Contravention Notice will issue in due course setting out, by schedule, details of the contravention, the grounds for the Inspector’s determination that a contravention has taken place and the actions required by the employer within a specified deadline (usually 21 days) to demonstrate compliance including, where relevant, the payment of any unpaid wages arising from the contraventions. The Inspector will work with the employer to achieve compliance.

Where employers do not engage with the Inspector, or do not demonstrate compliance, following the issue of the Contravention Notice, the matter may proceed to prosecution proceedings and, depending on the contravention involved, the issue of a Fixed Payment Notice and/or a Compliance Notice. In the Commission’s experience the majority of employers actively cooperate with Inspectors to achieve compliance.

Where contraventions are not detected, a closing letter will be issued to the employer by the Inspector.

Compliance Notices

Compliance Notices, provision for which is made under Section 28 of the Workplace Relations Act 2015, may be issued to employers by WRC Inspectors in respect of specified contraventions of employment legislation. Current practice and policy are that compliance notices will be issued where employers do not engage with the Inspector, or do not demonstrate compliance, following the issue of a Contravention Notice.

The following enactments and contraventions (20) are specified for the purposes of Compliance Notices: -

Enactment | Provision | Contravention |

Payment of Wages Act 1991 | Section 5 | Unauthorised deductions and under-payments |

Maternity Protection Act 1994 | Section 18 | Failure to grant leave on health and safety grounds |

Organisation of Working Time Act 1997 | Section 6(2) | Failure to give compensatory rest periods where employee is not entitled to rest period or break under sections 11, 12 or 13 of 1997 Act |

| Section 11 | Failure to give daily rest period (11 consecutive hours in each 24 -hour period) |

| Section 12 | Failure to give rest breaks at work (15 minutes every 4 hours and 30 minutes, 30 minutes after 6 hours) |

| Section 13 | Failure to give weekly rest (24 consecutive hours in each period of 7 days) |

| Section 14(1) | Failure to give compensation for Sunday working (allowance, increased pay, paid time off or combination) |

| Section 15(1) | Permitting an employee to work more than an average of 48 hours in each period of 7 days. |

| Section 16(2) | Permitting a night worker to work more than 8 hours in each period of 24 hours |

| Section 17 | Failure to provide information in advance on start and finish times |

| Section 18 | Failure to apply compensation to employees on zero-hour contracts |

| Section 19(1) | Failure to give annual leave entitlement |

| Section 19(1A) | Failure to deem a certified absence due to illness as a day of work for the purposes annual leave calculation |

| Section 21 | Failure to give public holiday entitlement |

| Section 22 | Failure to apply the correct rate of pay for the paid day off or additional day’s pay for public holidays |

| Section 23(1) | Failure to pay compensation for loss of annual leave on cessation of employment |

| Section 23(2) | Failure to pay compensation for loss of public holiday entitlement on cessation of employment |

Carer’s Leave Act 2001 | Section 13(2) | Failure to apply the annual leave provisions of Section 19 of the Organisation of Working Time Act 1997 to the first 13weeks of absence on carer’s leave |

Protection of Employees (Temporary Agency Work) Act 2012 | Section 14 | Failure to treat an agency worker no less favourable than an employee in relation to access to facilities and amenities at work |

Protected Disclosures Act 2014 | Section 6(3) | Failure to establish, maintain and operate internal reporting channels and procedures for the making of disclosure reports and for follow-up |

A Compliance Notice will -

- state the grounds on which the inspector is satisfied that a contravention of legislation has taken place,

- require the employer to do or refrain from doing such act(s) as/are specified in the notice, and by such date as is specified (Note - the date specified will not be earlier than that before which an employer is entitled to bring an appeal.), and

- contain information regarding the bringing of an appeal against the notice, including the manner in which an appeal may be brought.

An appeal against the notice may be made by the employer to the Labour Court not later than 42 days after the service of the notice. At a Labour Court Hearing of the appeal, both the inspector and the employer concerned may be heard and may present evidence. The Labour Court may affirm the compliance notice, withdraw the compliance notice or withdraw the notice and issue its own directions to the employer.

An employer may, within 42 days of the Labour Court decision or direction concerned, appeal to the Circuit Court against the decision or direction of the Labour Court. The Circuit Court may

a) affirm the decision or direction,

b) annul a decision of the Labour Court affirming a compliance notice and order the withdrawal of the notice, or

c) annul a direction of the Labour Court.

Failure to comply with a Compliance Notice is an offence, proceedings for which may be brought by the Workplace Relations Commission.

Where the Inspector is satisfied that the employer has complied with the Compliance Notice, they serve a notice (‘Notice of Satisfaction’) under Section 28(4) of the Workplace Relations Act 2015.

Fixed Payment Notices

Fixed Payment Notices, provision for which is made under Section 36 of the Workplace Relations Act 2015, may be issued to employers by WRC Inspectors in respect of specified offences under employment legislation. Current practice and policy are that fixed payment notices will be issued where employers do not engage with the Inspector, or do not demonstrate compliance, following the issue of a Contravention Notice relating to these offences.

The following enactments and offences (8) are specified for the purposes of Fixed Payment Notices: -

Enactment | Provision | Contravention |

Protection of Employment Act 1977 | Section 11 | Failure to initiate consultations in relation to collective redundancies |

Payment of Wages Act 1991 | Section 4(4) | Failure to issue a statement of wages and deductions (payslip) |

| Section 4(B)(8) | Failure to provide a tips and gratuities statement |

| Section 4(D)(2) | Failure to treat service charges as tips and gratuities |

| Section 4(E)(3) | Failure to post a tips and gratuities notice-employees |

| Section 4(F)(3) | Failure to post a tips and gratuities notice-contract workers |

National Minimum Wage Act 2000 | Section 23 | Failure to issue a statement of the hourly rate of pay |

Terms of Employment (Information) Act 1994 | Section 6(B) | Failure to provide a core (‘Day 5’) statement of terms of employment |

A Fixed Payment Notice will state that-

- the person is alleged to have committed a specified offence,

- the person may, within 42 days from the date of the notice, make payment of the prescribed amount, which should be accompanied by the notice, to the Commission,

- the person is not obliged to make the specified payment, and

- a prosecution in respect of the alleged offence(s) will not be initiated if the payment is made during the 42-day period.

A person who receives a Fixed Payment Notice may, within 42 days of the date of the Notice, make a payment to the Commission of the amount specified in the Notice. If the payment is made within the statutory 42-day period, a prosecution will not be instituted against such person.

Failure to make payment against a Fixed Payment Notice will result in prosecution proceedings being instituted by the Commission in relation to the specified offence.

Workplace Relations Act 2015 (Fixed Payment Notice) Regulations 2017